The meteoric rise of Nvidia over the past two years has made it the most recognizable name in the artificial intelligence (AI) hardware market. Its dominance in GPU design and its role in powering the world’s largest data centers fueled unprecedented stock gains and investor enthusiasm. Yet in 2025, cracks are beginning to show. Analysts warn that the hype surrounding Nvidia’s AI growth may not align with financial reality, as competition mounts and investor confidence wavers.

From Record Growth to Sharp Declines

In 2023, Nvidia’s stock soared by more than 239%, followed by another staggering 171% rise in 2024. These back-to-back surges cemented its position as the face of the AI revolution, with demand for its high-performance chips fueling the rally. However, as of early 2025, the company’s share price has dropped more than 21%, signaling growing unease.

Seaport Research Partners delivered one of the sharpest warnings, projecting Nvidia’s valuation at just \$100 per share, a dramatic fall from recent levels. This projection reflects concerns that much of the company’s growth story is already priced into the stock, leaving little room for upside. For investors, the question is whether Nvidia’s extraordinary run is sustainable—or whether the AI hype cycle has peaked.

Economic and Policy Headwinds

Beyond company fundamentals, broader macroeconomic pressures are weighing on Nvidia’s outlook. Trade tariffs introduced under President Trump’s administration have added uncertainty, raising costs for chipmakers and creating volatility in global supply chains. Combined with inflationary pressures and geopolitical risks, these headwinds are reshaping the market environment in ways that could dampen growth.

The AI sector itself is also under greater scrutiny. Billions have been invested in AI startups and applications, but not all have delivered tangible returns. As corporate spending tightens, investors are increasingly questioning whether AI projects will generate sustainable profits—or whether many will falter under the weight of inflated expectations.

The Rise of In-House Chip Development

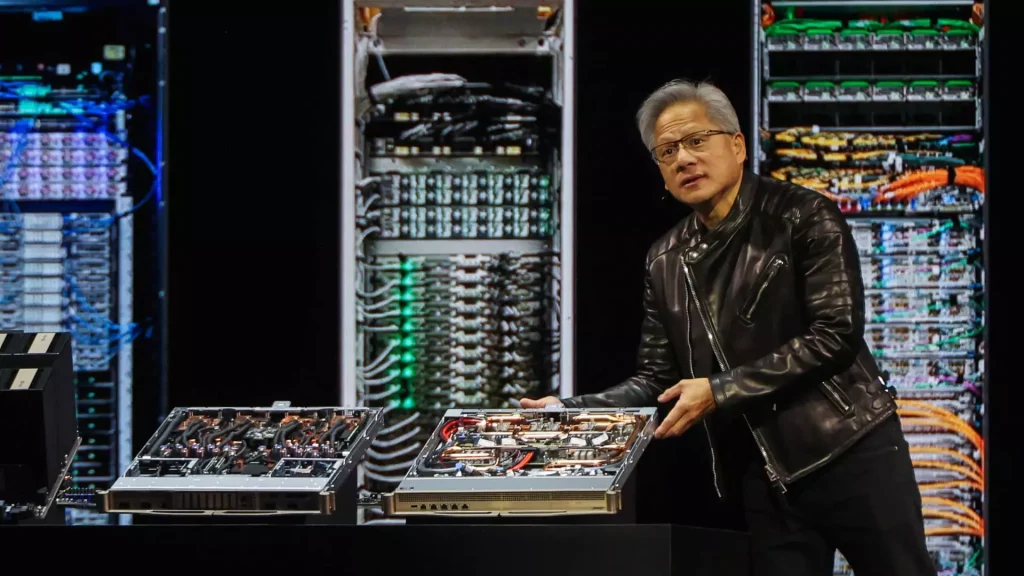

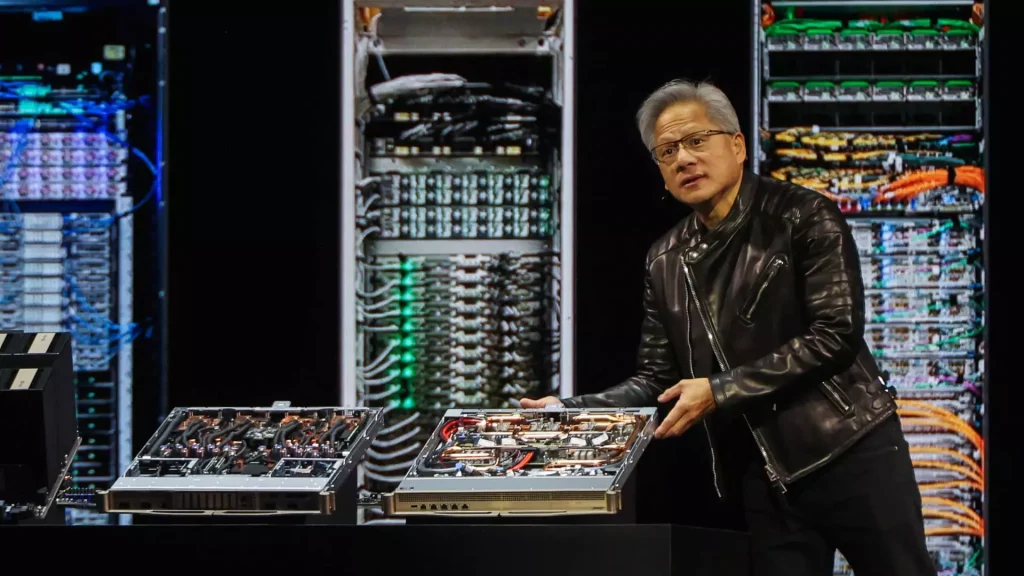

One of Nvidia’s greatest challenges comes from the very companies that helped fuel its rise. Tech giants such as Microsoft, Alphabet, and Meta have begun investing heavily in developing custom chips tailored to their needs. These hyperscalers represent Nvidia’s largest customers, but their pivot to in-house hardware development threatens to erode Nvidia’s dominance.

By building proprietary AI chips, these firms aim to reduce reliance on Nvidia’s GPUs and cut costs in scaling their massive AI operations. This shift could mark a turning point, as the same companies that once drove Nvidia’s record revenues increasingly become competitors. To maintain leadership, Nvidia must accelerate innovation and diversify beyond GPUs into software ecosystems and services that deliver lasting value.

Investor Sentiment Splits

While Seaport’s bearish stance has raised eyebrows, the broader analyst community remains largely optimistic. Nearly 87% of analysts continue to issue “buy” ratings, pointing to strong demand for Nvidia’s chips in cloud computing, generative AI, and high-performance computing. Some estimates even project up to 52% upside from current levels.

Yet this optimism may mask the risks of overreliance on bullish narratives. As the AI market matures, growth rates could slow, and Nvidia’s margins may face pressure from both competition and the cyclical nature of semiconductor demand. The divide between bullish forecasts and cautious warnings highlights the uncertainty surrounding Nvidia’s long-term trajectory.

The Mirage of AI Profitability

A growing concern among investors is the actual return on investment in AI. While Nvidia’s chips are powering breakthroughs in machine learning, natural language processing, and image recognition, many applications remain experimental or unproven in terms of profitability. The mismatch between soaring costs and unclear revenue streams raises the risk of disillusionment.

If corporate buyers begin cutting back on AI spending or if expected productivity gains fail to materialize, Nvidia could find itself exposed to a correction. For now, the company is benefiting from the wave of AI enthusiasm, but maintaining that momentum will require tangible results across industries.

Looking Ahead: Innovation or Plateau?

The critical question for Nvidia is whether it can sustain its growth by staying ahead of rivals and expanding into new areas. Its CUDA software ecosystem remains a strong competitive moat, and partnerships with cloud providers and AI researchers ensure its relevance. However, the pace of technological change in semiconductors is relentless. Without consistent innovation, Nvidia risks ceding ground to both established competitors like AMD and emerging internal challengers from hyperscale firms.

For investors, the lesson is clear: Nvidia is no longer the guaranteed winner of the AI race. The company must prove that its leadership is durable and that the AI boom can translate into long-term profitability rather than short-lived hype.

Conclusion

Nvidia’s remarkable run illustrates both the promise and peril of the AI revolution. While it remains a central player in the industry, rising competition, macroeconomic headwinds, and questions about AI’s real-world profitability are tempering investor enthusiasm. The stock’s recent decline may be a reality check that the market needed—a reminder that even the most celebrated companies are not immune to cycles of hype and correction.

The next phase will depend on whether Nvidia can continue to innovate and deliver tangible value in a crowded, evolving market. For investors, cautious optimism may be wiser than blind faith.